Financial Tools To Help You Save Money

/The digital age has made it easier for all of us to order food, watch our favorite TV shows, receive purchased items within hours, and thankfully for us, even save money towards a new home! The following five financial apps and websites make it a cinch to save big in no time:

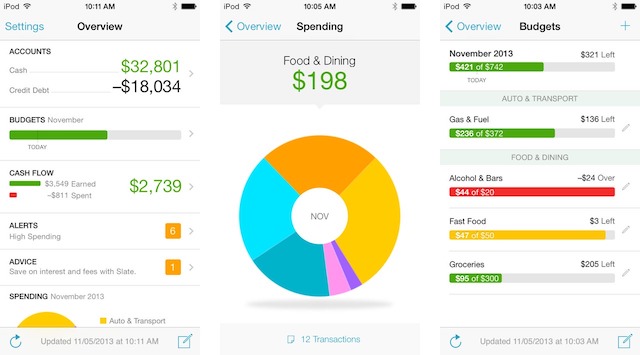

Mint is a great site to track your spending and create simple budgets. Once you've entered your online banking, credit and investment account information, Mint begins to automatically track your money. The default categories are sufficient for most people, but you can even add your own, for everything from restaurants to movies and travel. The site allows you to view your spending trends, as well as how much money you have in all your accounts at any one time. Mint comes with a free credit score and is owned by Intuit, so the data automatically feeds to TurboTax at tax time. The perfect way to start if you’re new to tracking your spending.

Acorns is a savings tool that helps users save money by automatically investing change from each charge. Just like a squirrel saves a few acorns everyday for the winter, so to will you be prepared when you need your acorns the most. With micro investing, every purchase helps save towards your future. For instance, if a transaction costs $1.50, Acorns rounds it up to $2 and sends those extra 50 cents into an investment portfolio diversified with ETFs. It’s a mindless way to save big, and has a low fee of $1 a month on account balances below $5,000 and 0.25% per year on balances over $5,000. You can also set recurring or one time investments to boost your savings if you’re looking to save more than a few cents at a time. Squirrels are going to be so jealous of your acorn stashing robot.

Leave the saving to the robots with Digit. This app monitors your income and spending habits, then stashes small amounts of money every few days (or whenever it thinks you won’t miss it) into a savings account. They never deduct more than what they think you can afford and even provide a ‘no overdraft’ guarantee. When you’re ready to access your savings, just transfer the money back into your bank account. Similar to Acorns, Digit moves money in small intervals so you won’t even notice you’re saving. If you want to save without any hassle, Digit is a great option (plus, it’s free!).

This budgeting app helps users learn to live on last month’s income. You Need A Budget directly imports transactions from your bank accounts, but requires manual categorization by the user. The app says this helps you raise your awareness about your spending, and also provides the user with a harsh wakeup call when they are forced to view all their Uber charges. Their envelope-based system allocates the exact amount of income available, putting a cap on spending. The app costs $50 a year, but might be worth trying if you want to work with your money hands-on.

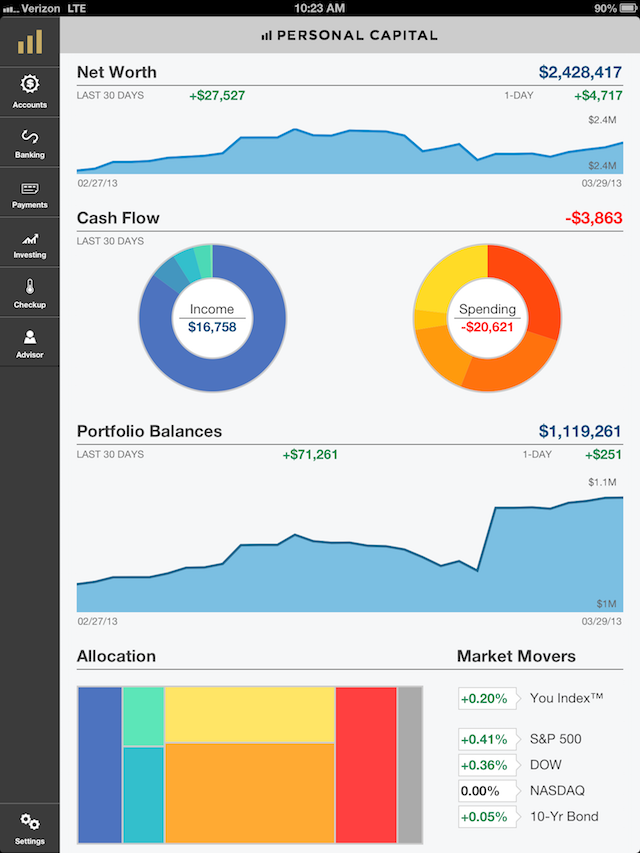

For personalized financial help, Personal Capital assigns users financial advisors to answer all their questions regarding anything and everything, including retirement planning, refinancing and obtaining a mortgage. The site also offers a 401(k) fee analyzer and a retirement planner which crunches numbers to tell users whether they’re on track to meet their savings goals. An investment checkup tool looks at the asset allocation in a user’s investment accounts and recommends a target allocation. If you’re looking for someone to guide you through more complicated investments, Personal Capital fits the bill.

Download these apps and you’ll be a financial wiz in no time! Or, at least, you’ll figure out how much you’re spending on lattes.